The coworking industry in India has grown into a major force in commercial real estate, offering flexible spaces for startups, freelancers, and enterprises. However, with growth comes the responsibility of proper GST compliance, which many operators still find confusing. This article breaks down how GST applies to coworking spaces, the correct HSN codes, applicable tax rates, and how platforms like DeskOS simplify everything through automation and compliance-first design.

GST and Coworking: What You Need to Know

Under Indian GST law, coworking services are treated as rentals of immovable property, since operators essentially provide access to physical workspace, meeting rooms, and shared amenities. This makes coworking services subject to GST under the “renting of immovable property” category.

As of 2025, coworking operators must charge 18% GST on all invoices issued to clients. This is split into:

-

9% Central GST (CGST)

-

9% State GST (SGST)

Even if the Client is registered in a different city, say a coworking space in Delhi, and a client whose company is registered in Maharashtra uses your space in Delhi, the tax will still be CGST + SGST. 9972 shall not be provided ever with IGST. This is because you are providing the service of Immovable Property.

HSN Codes for Coworking Services

To stay compliant, invoices must include the correct HSN (Harmonized System of Nomenclature) code. The relevant codes for coworking spaces are:

-

9972 – Real estate services

-

997212 – Rental or leasing services involving own or leased non-residential property

These codes clearly cover coworking and managed office rentals, which fall under the 18% tax bracket.

Including the correct HSN code is not optional — it’s mandatory for GST invoicing. Incorrect coding can result in mismatched filings and potential penalties during audits.

Common Mistakes Coworking Operators Make

Despite being well-intentioned, many coworking operators struggle with GST compliance. Some of the common issues include:

-

Using wrong HSN codes or omitting them completely.

-

Failing to split CGST and SGST correctly for intra-state transactions.

-

Manual invoicing errors, leading to mismatched GSTR-1 and GSTR-3B reports.

-

Not auto-reconciling input tax credits (ITC) from vendors or suppliers.

-

Missing monthly filing deadlines, resulting in interest or late fees.

As operations scale — multiple centers, dozens of clients, and hundreds of invoices — these manual processes become error-prone and time-consuming.

Why GST Compliance Matters More Than Ever in 2025

The Indian government has steadily tightened its compliance framework over the years. E-invoicing is now mandatory for businesses with turnover above ₹5 crore, and it’s expected to extend to smaller firms soon.

Coworking operators, especially those managing multiple centers or operating under a brand franchise model, must adopt automated systems to stay compliant with real-time GST reporting and e-invoicing.

Failure to comply can lead to:

-

Ineligibility for input tax credits

-

Penalties and delayed filings

-

Reputational damage during audits

But in 2025, you don’t have to do all this manually. You can use DeskOS which is the Best Coworking Software in India which can do all of this for you including e-Invoicing.

How DeskOS Simplifies GST for Coworking Operators

DeskOS was built with India’s complex GST framework in mind. Unlike generic accounting or coworking tools, DeskOS comes with inbuilt GST-compliant invoicing and e-invoicing support, ensuring accuracy across every transaction.

Here’s how it helps:

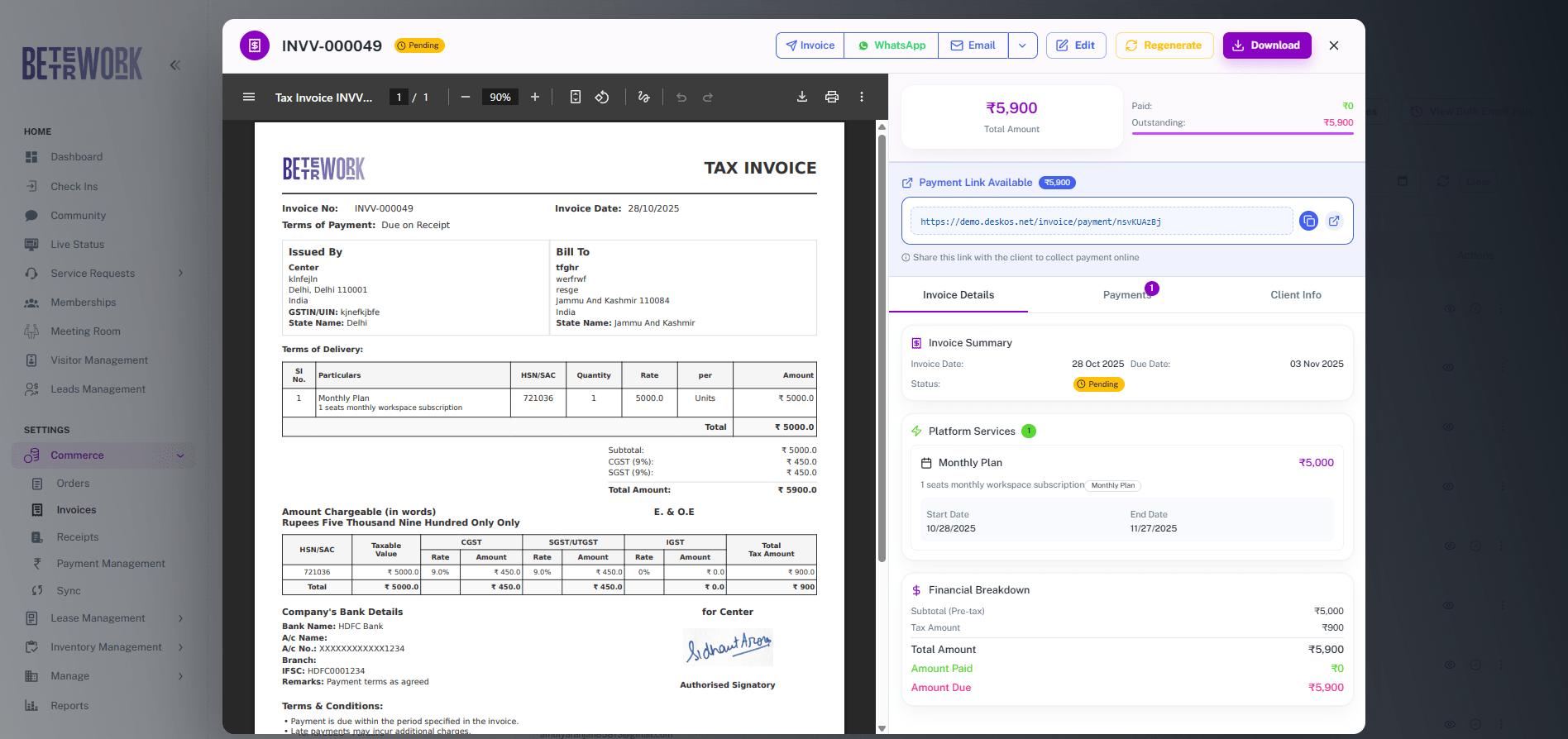

1. Automatic GST-Compliant Invoicing

DeskOS automatically generates monthly invoices for each client, complete with correct HSN codes (9972 / 997212) and split CGST/SGST or IGST depending on location. You don’t have to worry about tax math or formatting — every invoice is 100% compliant by default.

2. Seamless Accounting Integration

Integrations with Tally, QuickBooks, and Zoho Books ensure your invoices sync instantly with your accounting system. This reduces duplication, eliminates manual errors, and streamlines monthly returns.

3. E-Invoicing Ready

For businesses under the e-invoicing mandate, DeskOS automatically pushes invoices to the government IRP (Invoice Registration Portal) and retrieves IRNs — saving hours of manual uploads.

4. Automated Reports and Tax Summary

Operators can access real-time GST summaries across centers — ideal for reconciling GSTR-1, GSTR-3B, and ITC reports before filing. The dashboard provides visibility into total tax collected, pending invoices, and month-wise performance.

5. Smart Reminders and Filing Assistance

Never miss a deadline again. DeskOS sends automated reminders for due filings and helps you generate all necessary data exports for your GST consultant or CA.

Sign up on DeskOS Here: DeskOS Signup

Beyond Invoicing: A Complete Coworking Management Suite

While GST compliance is crucial, DeskOS goes beyond billing. It’s a complete coworking management superapp designed to handle everything from:

-

Meeting room bookings

-

Service requests

-

Community management

-

Lease and visitor management

-

Café and printing operations

-

White-labeled tenant apps

-

Advanced reporting and analytics

By integrating financial, operational, and community functions, DeskOS ensures coworking operators spend less time managing spreadsheets and more time growing their business.

Why Coworking Operators Are Moving to DeskOS

Operators across India are shifting from manual tools and legacy software to DeskOS because of three key reasons:

-

Compliance Confidence: GST, e-invoicing, and accounting integrations all work seamlessly.

-

Automation: Every recurring task — from invoicing to meeting room bookings — runs on autopilot.

-

Scalability: Whether you run one center or 50, DeskOS adapts to your operations.

Starting at just ₹4,999 per month, it’s built to deliver enterprise-grade automation at an accessible cost for Indian operators.

Final Thoughts

As coworking continues to expand across India, operators can’t afford to overlook GST compliance. With the correct use of HSN codes 9972 or 997212 and charging 18% GST (9% CGST + 9% SGST) on all coworking services, you stay legally compliant and build credibility with your members.

And with DeskOS, you can automate every part of this process — from generating GST-compliant invoices to filing-ready reports — while managing your entire coworking business from a single dashboard.

GST compliance doesn’t have to be complex. With DeskOS, it’s automatic.